The moment after a car accident is already overwhelming. But for thousands of UK drivers this year, the real shock has come later, when insurance payouts failed to cover outstanding finance. That gap between what insurers pay and what drivers still owe is quietly becoming a national talking point. As vehicle prices fluctuate and finance deals grow more complex, ala gap insurance is suddenly trending across the United Kingdom.

Search interest is rising, brokers are reporting record enquiries, and social media is filled with real-life stories of drivers left thousands of pounds out of pocket. This is not a future risk anymore. It is happening now, and UK motorists are paying attention.

What Is Driving the Sudden Interest in ALA Gap Insurance

At its core, ala gap insurance protects drivers from the financial shortfall after a car is written off or stolen. Standard comprehensive insurance only pays the current market value of the vehicle. However, car values depreciate faster than most people expect, especially in the first year. When finance or lease balances remain higher than that payout, drivers are left covering the difference themselves.

What’s changed is scale. With average new car prices in the UK rising sharply over the past few years, the gap between market value and outstanding finance has widened. As a result, ala gap insurance is no longer seen as an optional extra. For many drivers, it’s becoming a financial safety net they wish they had taken sooner.

Rising Car Prices Are Changing Insurance Decisions

The UK car market has gone through dramatic shifts. Supply chain disruption, electric vehicle demand, and higher production costs pushed prices to record levels. Even used cars experienced unusual inflation, followed by sharp corrections. This volatility has made depreciation harder to predict, catching many drivers off guard.

In this environment, ala gap insurance has gained relevance because it addresses uncertainty. Drivers who financed vehicles at peak prices are now exposed to higher write-off risks. When insurers assess market value months later, the numbers often fall short. This mismatch is exactly why gap cover is trending in financial advice circles across the UK.

How ALA Gap Insurance Works in Real-Life Scenarios

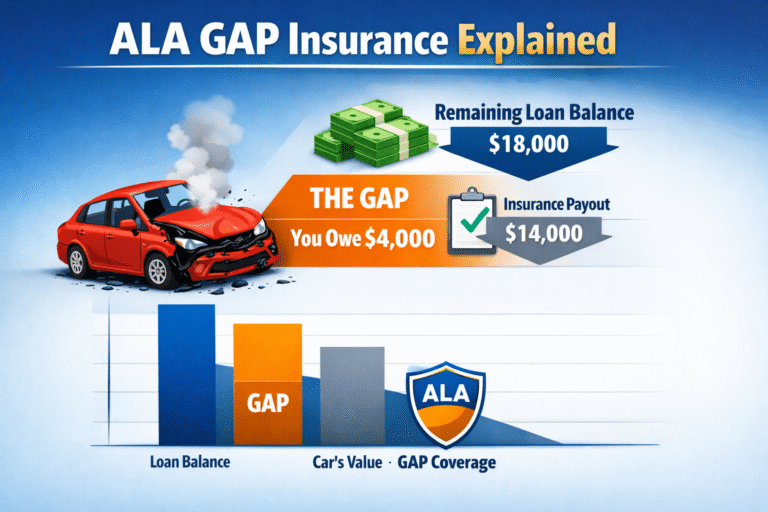

To understand the value of ala gap insurance, consider a common scenario. A driver buys a car for £30,000 using a finance agreement. After a year, the car is written off. The insurer values it at £23,000, but the remaining finance balance is £27,000. Without gap insurance, the driver must pay the £4,000 difference.

With ala gap insurance in place, that shortfall is covered, protecting the driver from unexpected debt. These real-world cases are no longer rare exceptions. According to industry estimates, a significant percentage of total-loss claims now involve a negative equity gap, making this type of protection increasingly relevant.

Why UK Drivers Are Rethinking Traditional Insurance

For years, many drivers assumed comprehensive insurance meant full protection. The reality is more complicated. Comprehensive policies are designed to replace the vehicle, not the financial agreement attached to it. This distinction is now better understood, largely due to online discussions and consumer awareness campaigns.

As understanding improves, ala gap insurance is being viewed as a logical extension of car insurance rather than an upsell. Financial advisers in the UK are increasingly highlighting it alongside breakdown cover and legal protection, especially for drivers using PCP, HP, or lease agreements.

The Role of Finance Deals and PCP Agreements

Personal Contract Purchase agreements dominate the UK car finance market. While they offer lower monthly payments, they also create higher exposure to depreciation. Early in the contract, drivers often owe more than the car is worth. This imbalance is where risk quietly builds.

Ala gap insurance directly addresses this structural issue. As PCP contracts become more common, so does the potential for financial loss after a write-off. This connection explains why gap insurance searches spike alongside new car registration data, especially during peak buying seasons.

Market Stats That Explain the Trend

Recent consumer finance data shows that over 90 percent of new cars in the UK are purchased using some form of finance. At the same time, average annual depreciation can exceed 20 percent in the first year alone. These numbers paint a clear picture of growing financial exposure.

Insurance industry reports also suggest that total-loss claims are increasing, partly due to higher repair costs making write-offs more likely. Combined, these factors explain why ala gap insurance has moved from niche product to mainstream discussion in a short period of time.

Common Myths Around Gap Insurance in the UK

One persistent myth is that gap insurance is only for luxury cars. In reality, depreciation affects all vehicles, regardless of brand. Another misconception is that it’s overpriced or unnecessary. However, when compared to the potential cost of an uncovered shortfall, premiums are relatively modest.

There is also confusion about dealer-provided gap cover versus independent providers. Many drivers are now researching alternatives, comparing terms, and understanding exclusions. This shift toward informed decision-making is a key reason ala gap insurance is gaining traction in consumer news coverage.

How Economic Pressure Is Shaping Buyer Behaviour

The cost-of-living crisis has changed how UK households approach financial risk. Unexpected expenses are harder to absorb, making protection products more appealing. Drivers want predictability, especially when managing monthly budgets already stretched by fuel, tax, and maintenance costs.

In this climate, ala gap insurance appeals because it removes one major unknown. Knowing that a total-loss event won’t result in sudden debt offers peace of mind. This emotional factor, not just financial logic, is influencing purchasing behaviour across the country.

Future Outlook for ALA Gap Insurance in the UK

Looking ahead, analysts expect demand for ala gap insurance to remain strong. Electric vehicles, while cheaper to run, often have higher upfront costs and faster early depreciation. That combination increases the potential gap between market value and finance balance.

Regulatory attention may also shape the market. Greater transparency around add-on insurance products is expected, pushing providers to improve clarity and value. Rather than reducing demand, experts believe this will build trust and further normalise gap insurance as part of responsible car ownership.

What UK Drivers Should Consider Before Buying

Before purchasing ala gap insurance, drivers should assess how their vehicle is financed, how long they plan to keep it, and their tolerance for financial risk. Reading policy details carefully is essential, especially regarding claim limits and eligibility periods.

Timing matters as well. Most policies must be taken out shortly after purchasing the vehicle. Waiting too long can limit options or increase costs. As awareness grows, more drivers are making this decision early rather than reacting after a loss.

Why This Trend Matters Right Now

The rise of ala gap insurance reflects a broader shift in how UK consumers approach protection. It signals greater financial awareness and a response to real economic pressure. This is not fear-driven buying. It’s experience-driven learning, often shaped by stories of loss shared online.

If you’re financing a car in today’s unpredictable market, ignoring this conversation could be costly. Take time to understand your exposure, compare options, and make informed choices. The next headline you read about insurance might involve someone who wished they had acted sooner. Stay ahead of the curve and protect your financial future today.

You may also read

Wings Hull Prices Surge Across the UK: What Buyers Must Know Now